What to Expect from an Expert Forex Trading Course in 2024

What to Expect from an Expert Forex Trading Course in 2024

Blog Article

Money Exchange Explained: Trick Ideas and Techniques for Aspiring Traders

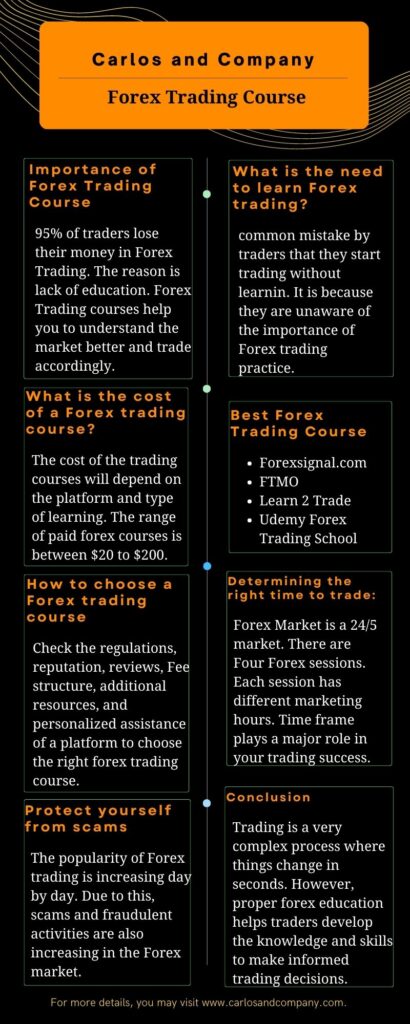

Currency exchange, a cornerstone of international monetary markets, involves the complicated interaction of money sets, where the base money is determined versus a quote money. Ambitious investors have to browse the nuances of fluctuating exchange prices influenced by financial indications such as rates of interest and geopolitical occasions. Mastery of trading methods, including both technical and basic evaluation, is vital. forex trading course. Executing durable risk administration methods like stop-loss orders and diversification safeguards versus volatility. To properly exploit on market movements, one should additionally understand the subtle art of analyzing market trends and view indicators-- a skill that distinguishes effective traders.

Comprehending Money Pairs

In the world of forex, comprehending money sets is fundamental to browsing the market efficiently. Currency sets are the core instruments sold the forex market, representing the relative value of one currency versus one more. Each pair contains a 'base currency' and a 'quote money.' The base money is the initial currency provided in both, while the quote currency is the 2nd. In the EUR/USD pair, the euro (EUR) is the base currency, and the US dollar (USD) is the quote currency.

The worth of a currency set is figured out by just how much of the quote money is needed to purchase one device of the base money. This partnership is shared in the exchange rate, which changes based on numerous economic variables. Major currency sets, such as EUR/USD, USD/JPY, and GBP/USD, are the most traded and are understood for their liquidity and tighter spreads. Understanding these sets permits investors to make enlightened decisions, evaluate market fads, and carry out trades effectively. Proficiency of money sets is essential for anyone looking to participate in foreign exchange trading, as it creates the basis for all trading approaches and run the risk of assessments.

Exactly How Exchange Fees Work

They identify the family member worth of different money and are critical for transforming one money into one more. Understanding exactly how these rates function is essential for investors, as they impact the profitability of cross-border transactions and investments.

In a fixed exchange rate system, a nation's money value is secured to one more major currency or a basket of currencies. The majority of major money today operate under a drifting exchange price system, allowing for even more versatility but increased volatility.

In addition, currency exchange rate can be priced estimate in two methods: straight and indirect quotation. A direct quote reveals the residential money in regards to an international currency, while an indirect quote does the opposite. Comprehending these concepts is basic to browsing the intricate world of currency trading.

Important Trading Strategies

Browsing the unpredictable waters of fx markets requires investors to employ crucial trading methods that enhance their decision-making and danger monitoring. Among these, technical evaluation and essential evaluation are fundamental. Technical analysis includes evaluating historic cost information and graph patterns to anticipate future movements, while YOURURL.com basic evaluation he said checks out financial indications, news occasions, and geopolitical aspects influencing currency values. Proficiency of these evaluations allows traders to recognize possible entry and departure points.

Another vital method is fad following, which utilizes on the energy of monetary markets. Conversely, variety trading, suitable for stable markets, includes recognizing rate degrees of support and resistance, allowing investors to acquire at lows and market at highs.

Furthermore, employing a disciplined strategy through making use of stop-loss orders is important. These orders instantly close settings at established degrees, reducing potential losses. Placement sizing, establishing the amount to trade based upon account dimension and risk tolerance, more assistances critical implementation. By integrating these techniques, traders can browse forex markets with enhanced effectiveness and self-confidence.

Risk Administration Techniques

Reliable trading in the international exchange market not only depends on robust approaches however also get redirected here on a thorough understanding of danger monitoring strategies. This protective procedure allows investors to reduce danger without needing consistent market surveillance.

One more important facet is setting sizing, determining just how much resources to assign to a solitary profession. By calculating the optimal setting dimension based on account size and threat tolerance, traders can avoid excessive exposure to any kind of single trade, shielding their profiles from considerable declines. Diversity even more enhances danger monitoring by spreading out financial investments across numerous currency pairs, minimizing the influence of negative activities in any kind of one currency.

Leverage, while providing the possibility for intensified returns, must be managed prudently. Extreme leverage can bring about considerable losses, so it is crucial for investors to utilize take advantage of carefully and straighten it with their threat hunger. Frequently evaluating and readjusting threat monitoring methods based on advancing market conditions ensures that investors continue to be adaptable and durable when faced with market volatility.

Analyzing Market Trends

Comprehending market fads is vital for successful currency trading, as it allows investors to make educated decisions based on prevailing financial conditions and market view. Assessing market trends involves examining historical cost activities and current financial indications to predict future rate action. This evaluation can be classified right into 2 primary techniques: basic analysis and technological analysis.

Alternatively, technological analysis involves examining rate graphes and patterns to identify fads and potential reversals. Traders make use of various tools, such as relocating standards and trend lines, to detect signals and make forecasts. Identifying patterns like head-and-shoulders or double tops can indicate possible market shifts, giving valuable understandings into future cost motions.

Furthermore, understanding market view is vital in trend analysis. Belief indicators, such as the Commitment of Investors (COT) report, assistance investors determine the market's state of mind, enabling them to align their methods with the more comprehensive agreement. With each other, these techniques gear up traders with the understandings required to navigate the vibrant currency markets effectively.

Final Thought

Grasping currency exchange calls for a detailed understanding of currency sets, exchange rate characteristics, and the implementation of important trading techniques. Analyzing market fads and using sentiment indicators can additionally boost decision-making and success in the volatile currency market.

Report this page